Table of Content

The personal portion of deductible mortgage interest you included in column of line 6. For example, if your business percentage on line 3 is 30%, 70% of the amount you included in column of line 6 is deductible as an itemized deduction on Schedule A. In general, you will deduct the business portion of these expenses on Schedule C or Schedule F as part of your deduction for business use of your home. If you itemize your deductions, you will deduct the personal portion of these expenses on Schedule A .

She adds line 23, column , and line 24 and enters $1,756 ($171 + $1,585) on line 26. This is less than her deduction limit , so she can deduct the entire amount. She follows the instructions to complete the rest of Part II and enters $1,756 on lines 34 and 36. If your qualified business use was for a portion of the year or you changed the square footage of your qualified business use, your deduction is limited to the average monthly allowable square footage. You calculate the average monthly allowable square footage by adding the amount of allowable square feet you used in each month and dividing the sum by 12.

Services

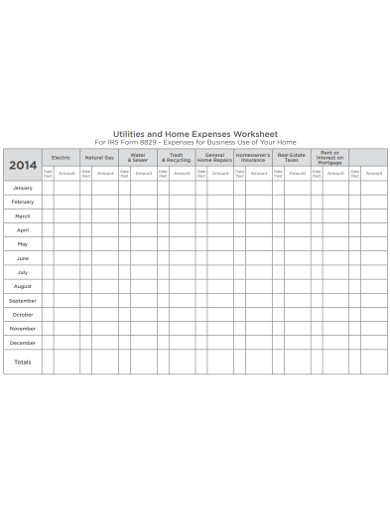

At NYU, Tappe allegedly routed the grant intended for minority and women owned businesses to bank accounts held by two shell companies she created, according to the DA Office. Some of the funds were used for NYU payments and employee reimbursements but more than $660,000 went toward Tappe’s personal expenses, including an $80,000 swimming pool. This is designed for use by a self-employed person in order to calculate how much to claim as a tax-deductible expense for working from home.

Use this worksheet if you file Schedule F or you are a partner, and you are using the simplified method to figure your deduction for business use of the home. If you deducted actual expenses for business use of your home on your 2020 tax return, enter on line 29 the amount from line 42 of your 2020 worksheet. If you used the simplified method in 2020, enter on line 29 the amount from line 6b of your 2020 Simplified Method Worksheet. You can use any other reasonable method that accurately reflects your business-use percentage.

Married? You may be able to save £220 in tax!

To qualify under the trade-or-business-use test, you must use part of your home in connection with a trade or business. If you use your home for a profit-seeking activity that is not a trade or business, you cannot take a deduction for its business use. However, if you add an additional payment every month of $500 from your discretionary income, you’ll cut your mortgage term in half and have your house paid off in 15 years. By having a list of your monthly expenses and pairing that list against your monthly income, you can arrange your spending in a way that aligns with your true financial goals. Deductions from the business use of a home cannot be claimed if these costs are higher than the home office expenses. A home office does not necessarily need to be permanent, and using such space for the dual purpose of business and personal use disqualifies it from being a home office.

On August 5, she expanded the area of her qualified use to 330 square feet. Amy continued to use the 330 square feet until the end of the year. Andy files his federal income tax return on a calendar year basis. On July 20, he began using 420 square feet of his home for a qualified business use.

About Form 8829, Expenses for Business Use of Your Home

A rental use that qualifies for the deduction must be figured using actual expenses. If the rental use and a qualified business use share the same area, you will have to allocate the actual area used between the two uses. You cannot use the same area to figure a deduction for the qualified business use as you are using to figure the deduction for the rental use. In making this determination, consider the time you spend at each location, the business investment in each location, and any other relevant facts and circumstances. Other expenses are deductible only if you use your home for business.

The fair market value of your home is the price at which the property would change hands between a buyer and a seller, neither having to buy or sell, and both having reasonable knowledge of all necessary facts. Sales of similar property, on or about the date you begin using your home for business, may be helpful in determining the property's fair market value. If you own your home, you cannot deduct the fair rental value of your home.

Expenses and benefits: homeworking

Do not include payments or expenses for your own children if they are eligible for the program. Follow this procedure even if you receive a Form 1099-MISC, Miscellaneous Information, reporting a payment from the sponsor. The expenses she paid for rent and utilities relate to her entire home.

If you began using the property for personal purposes before 1981 and change it to business use in 2021, depreciate the property by the straight line or declining balance method based on salvage value and useful life. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or sufficient evidence to support your own statements.. If your business use of listed property is 50% or less, you cannot take a section 179 deduction and you must depreciate the property using the Alternative Depreciation System . A loss from the sale of your home, or the personal part of your home if it was also used for business or to produce rental income, is not deductible.. You do not have to reduce the gain by any depreciation you deducted for a separate structure for which you cannot exclude the allocable portion of the gain. If you were entitled to deduct depreciation on the part of your home used for business, you cannot exclude the part of the gain equal to any depreciation you deducted for periods after May 6, 1997.

Many businesses these days are based from the home, and with technology and the use of the Cloud this will become more and more prevalent. To claim home expenses for business use, you simply fill in Part 7 of the form and file it to the CRA. You must keep record of each expense you intend to deduct with invoices and receipts. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. Tax-related identity theft happens when someone steals your personal information to commit tax fraud.

If you used more than one home in your business during the year , you can elect to use the simplified method for only one of the homes. You must figure the deduction for any other home using actual expenses. If your business expenses related to the home are greater than the current year's limit, you can carry over the excess to the next year in which you use actual expenses.

No comments:

Post a Comment